A year in Nigerian Health Tech — 2020 review and 2021 predictions

Intro

Phew! What a year 2020 has been. The Covid-19 pandemic dominated the year on all fronts. This led to an unprecedented acceleration in health innovation the world over. In Nigeria, we finally saw health care get everyone’s attention leading to progress on many fronts. We saw several health tech companies raise significant funding and telemedicine began to go mainstream among other occurrences. As is now customary, I review the year in Nigerian health tech/ innovation and tease out some themes/ trends to track going into 2021. Click on the corresponding year below to review the 3 previous editions of my annual review/ predictions.

The 2017 edition is useful to review as there are parallels in Nigeria’s current macro-economic situation that make it doubly relevant. Here goes the fourth edition of Docneto’s annual health tech review.

Covid-19

Like me, you’re probably sick of all things Covid. It did, however, define the year so it’s as good a place as any to start a review of the year.

Ventures platform alongside a number of partners held a covid innovation challenge in March that selected 7 solutions. This was one of a number of innovation challenges that seemed to exist at every turn. Outside of the challenges themselves, many tech-based solutions popped up to help different aspects of the pandemic response. Other products pivoted away from their primary focus towards health/ covid-19 response.

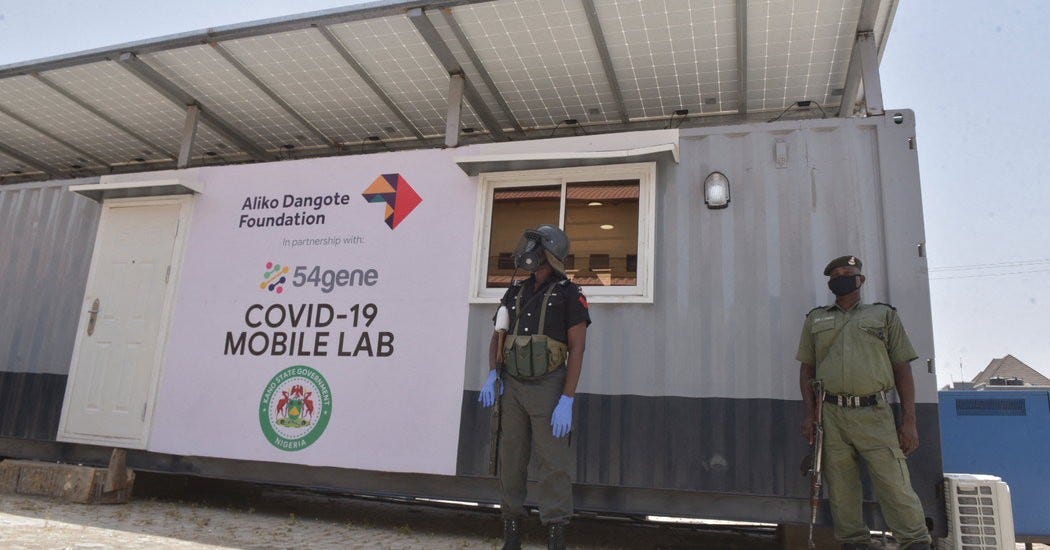

One startup that made significant strides with covid-19 was 54 gene. They began by launching a multi-million dollar COVID-19 Testing Support Fund. They then went on to launch several testing facilities across a number of Nigerian states. If there was any one startup that won 2020, it was 54 gene. Their timing for the pandemic was impeccable.

Similarly, Mdaas and Flying doctors worked on mobile lab solutions to improve sample collection and testing for covid-19.

We’re many months since the onset of the pandemic and while there’s been clear progress for health tech adoption, it’s still unclear what the long term outlook will be. I’m optimistic that a corner has been turned thanks to the pandemic and that more opportunities will arise for health tech adoption and innovation. Perhaps the logistics of delivering the Covid-19 vaccine might prove one more opportunity to firmly cement the place of health tech innovators in the health system. I’m bullish on the prospects of health tech going into 2021.

Telemedicine

With covid-19 mandated social distancing and remote working, the use case for telemedicine became more pressing. The Lagos state government launched Eko telemed, a telemedicine service for non-Covid-19 medical consultations. This was in conjunction with a telemedicine startup, Healthconnect 24/7. Launched in April, this was a harbinger of increased telemedicine solutions to come.

Throughout the year, telemedicine startups saw more traffic and inked several partnerships with governments, medical associations, HMOs and banks to provide telemedicine services. Leading the way was Tremendoc who inked a number of these deals and invested in significant OOH advertising to promote their services. 2020 threatened to be the year that takes telemedicine mainstream. It remains to be seen if this interest, driven largely by the pandemic, will persist into 2021. In April, I penned a piece on telemedicine and while I’ve always been pessimistic about its prospects in Nigeria, there is now a clear opportunity to capitalize on the current scenario to drive home the benefits of telemedicine.

Will 2021 finally be the year of telemedicine, Lai Lai! I’m still not a believer.

Health Fintech

Coming into 2020, my big prediction was that the year would see the rise of health fintech (or is it fin-health tech). While covid-19 overshadowed this, there were still several strides worthy of note. Anyi health launched via the Antler Nairobi program where it secured $100,000 in funding. They provide consumer health loans in partnership with health providers. As I specifically predicted, helium health made a big push into credit for providers. There was further expansion of the vendor managed inventory model with the likes of Shelflife and mpharma (who made $16 million in revenue) seeing more adoption across several cities.

Following Interswitch’s acquisition of eclat last year, I hoped to see more activity from them. Short of their work with the Edo state government (they power Edo state’s health improvement program), there wasn’t much public information of what they got up to throughout the year. I reckon there will be more activity from Interswitch on the healthcare front in 2021 and health fintech will become even more pervasive. I think however that this will be driven more so by fintech companies who will seek to embed healthcare options in a bid to differentiate their offerings in a super competitive fintech landscape.

Fundraises

2020 was another big year for health tech fundraising across Africa (as I’d predicted). The sector pulled in over $103 million across 55 deals.

Significant rounds included mpharma’s $17 million round, 54 gene’s $15 million round and Helium health’s $10 million round. Other fundraises of note included Lifestores pharmacy, Field intelligence, Medsaf and Healthlane. The latter took part in the famous silicon valley accelerator, Y Combinator and raised a $2.4 million seed round. All this capital points to the allure that the Nigerian health sector is beginning to gain in the eyes of investors.

I predict that 2021 will see even more funding come into the space to support the growth and development of new and existing health tech startups. Worthy of note is that most of these significant fundraises have been for startups founded circa 2015/2016. Seems it takes around 4 years for health tech startups to really get into their stride.

Corporate Partnerships

2020 seemed to be the year of corporate partnerships. Wellvis lined up with FCMB, Myclinic partnered with Jazzbank, Aella credit partnered with Hygeia to provide health insurance to its users. Tremendoc had a roster of partnerships with Sterling bank, Union bank, Standard Chartered and more. Beyond these partnerships, banks in particular took a deeper interest in healthcare. GT bank launched and began to promote its health insurance offering, ‘Beta health’. Sterling bank moved beyond its Tremendoc partnership to create healthbanc, a health insurance solution for consumers that also provides tech and credit solutions for health providers.

This trend of corporate partnerships will persist in 2021. The pandemic has revealed the risk poor healthcare poses to staff and customers of corporates. They will thus continue to seek partnerships to provide health benefits to the customers and communities they serve. Whether or not startups will be the best partners to help them reach their goals is yet to be seen as these partnerships take a long time to be productive and startups generally don’t have the luxury of time. I’m still optimistic, however, and dub 2021 the year of partnerships to drive health tech innovation.

New Markets

2020 saw Lifebank launch in Kenya and Helium Health earnestly pursue its Africa wide ambition as it hired MEST’s Alexis Roman as its head of new markets. Vezeeta, the Egyptian doctor booking startup with significant MENA presence, launched in Nigeria on the heels of its $40 million Series D funding. Konga made moves to get into pharmaceuticals as they sought to hire a head for this business line and Ilara health, the Kenyan based diagnostics startup, raised over $3 million with ambitions of expanding into Nigeria.

As the pandemic subsides over 2021, we will see more startups expand into new markets to deploy the capital they’ve raised in order to chase growth. This will come with the attendant difficulty of scaling and the danger that premature scaling can pose to startups. It will be interesting to see how startups navigate this challenge. I have faith in the skilled operators in these startups to build successful businesses as they scale into new markets.

Conclusion

These are but few of the things/ themes to watch in the health tech sector over the year. 2 Other stories that stood out in 2020 are:

Soga of Mdaas winning second place in Jack ma’s Netpreneur prize following on from Lifebank’s win the previous year.

Healthplus’ founder and CEO going through a huge public battle with her PE investors who seemed hell-bent on replacing her.

Altogether, 2020 was an eventful year that nobody saw coming. Many health tech startups made the most of it and grew significantly. 2021 will be no different, the health tech sector will see more investment, more partnerships and will continue its match towards becoming mainstream. Growth will be immense and I reckon there will begin to be a trend towards consolidation so that startups can jointly take advantage of partnership opportunities. This consolidation and partnerships will also beget a pathway to exit for some of the later stage startups.

Reviewing all the past editions of my annual review show the significant progress that’s happened in the sector over the last 4 years and suggests that the sector is finally coming of age. I’m excited for another blockbuster year in health tech.