Introduction

Welcome to the 5th edition of my annual state of healthtech in Nigeria review. I began writing this back in 2016 and can’t believe it’s 5 years now. You may review the previous 4 editions via the following links.

2021 has been a blockbuster fundraising year for African startups. Nigerian startups, in particular, have raised over $1.4b in the year. Furthermore, a record number of African startups made it into leading global startup accelerators such as Techstars and Y Combinator. Big tech hasn't been left out of the action. Google committed significant funding and support to companies on the continent via its black founders’ fund and several other initiatives. All this points to a certain coming of age for African tech.

Despite this growth, health tech funding still lags behind other sectors. Health made up about 4% of the total funding amount on the continent. A far cry from the 57% that's gone to fintech. Considering that we've been in the throes of a pandemic for about 2 years now, that doesn't seem to be ending anytime soon, is 4% adequate? Is the industry maturing fast enough? What is the state of health tech in Nigeria today? Here I attempt to review the current state of healthtech in Nigeria and look forward to what 2022 holds.

Funding

The advent of the pandemic brought with it dreams of increased funding for healthtech. This however is yet to materialize. The bulk of funding coming into the healthtech space continues to be via sub $200k grants or accelerator investments. In fact, publicly available funding data for 2021 shows that only 19 companies received funding. 57% of this was from grants and the median deal size was a meagre $100,000. Big rounds like 54 gene's $25m series B are still few and far between in healthtech. Africa Health Holdings raised significant funding but is Ghana-based although it does have a Nigerian footprint. It’s also not universally considered to be a ‘proper’ startup. Other significant rounds include $2.6m for CribMd, Mdaas' $2.3m seed extension, rxall's $3m round and drugstoc's $4.4m series A. The latter 2 are both pharma focused, a sub-sector that continues to lead the way in volume and value of deals.

A big story for funding has been the significant gender gap in VC funded companies in Africa. The health tech data differs somewhat. Over 50% of funded health tech startups have a female co-founder and 36% are led by a female CEO compared to 18% and 1% respectively in the broader funding data. In relation to the age of startups, the data shows that on average, the age of funded companies is 5 years. This points to the difficulty health tech startups face fundraising and the long time and effort it takes to get funded. This is a huge nod to the tenacity and grit healthtech founders in Nigeria possess.

Kudos must go to the investors who are taking an early bet on the industry. Investors such as Ingressive capital, Launch Africa and future Africa have been the most active. There are also several emerging funds focused on health care in Africa this includes funds such as Assiduity capital, Akinned and Black pearl Global with several more under the radar. Finally, one can’t ignore the effect of Google who has committed millions of dollars in funding to health tech across Africa via grants, programs and other supports. More big tech (and big pharma) support is needed in the space and way more investors should look to health tech for outsized opportunities.

I want to predict more healthtech funding in 2022 but that surely is a given. I would rather love to see larger funding rounds going to support the growth and deeper penetration of older startups. With an average age of 5 years, surely it’s time for this to happen. 2021 has been awash with stories of African unicorns. Will the new year herald a healthtech unicorn? I wouldn’t hold my breath, we’re not quite there yet.

Pharma

The pharma tech subsector has attracted the most funding to date. Startups like mpharma, field intelligence, lifestores pharmacy, advantage health, rxall and medsaf have cumulatively raised over $70m. Most of the startups in this sector help with pharmaceutical procurement and inventory financing. Newer startups like ‘One health’, have joined the online pharmacy race where advantage health's my-medicines.com is a pioneer followed by drugstore.ng. Healthplus, a traditional retailer not wanting to be left behind made a push to digital by launching their own online pharmacy offering. Another new pharma startup that's receiving investor interest is remedial health. They in addition to procurement and inventory financing, also provide private label medicines. All this activity makes a ton of sense as Nigeria's pharma market is massive. Several manufacturers are publicly listed and many more successful pharma importers exist. The 2017 national health accounts show that over N1 trillion ($3 billion back then) was spent in pharmacies. Medical goods make up 31% of expenditures by healthcare function.

Beyond the local, global pharma manufacturers have always been interested in the Nigerian market and are putting in more funding towards growing the market. Imperial, a South Africa based conglomerate that owns the largest pharma distribution outfit in Nigeria has a venture fund that's taking an active position in pharma startups. This pharma tech sector is now solidly in a growth phase. The entry of a big e-commerce player like Konga via their Konga health offering further buttresses this.

It seems that the industry is increasingly ripe for consolidation and acquisitions or the possible entry of a large international player. An adjacent inspiration is in the laboratory space where Synlab, a European lab outfit, entered the lab market via acquiring Pathcare. Something similar may well happen in retail pharma. The possibility of this may, however, be tempered by the recent woes of healthplus a leading retail chain that faced a lot of boardroom drama with its PE investors ousting the chain’s founder. mPharma has been on a physical retail rollout spree in several markets so maybe just maybe they splash out on a Nigerian chain over and beyond their franchising offering.

All this progress is well and good but there's one big elephant in the room to be addressed, that of regulation. As sectors mature and attract significant funding, regulation becomes more of a risk. The Pharmacists Council of Nigeria (PCN) recently released draft guidelines for online pharmacy without much industry consultation and look set to begin regulating the industry more. Extant regulations as well around pharmacy ownership and the limitations on chains make some of this predicted growth and acquisitions tricky. All in all, the pharma space will continue to be interesting and attract even more interest and growth in 2022.

Hospitals

Data from Nigeria's national health accounts indicate that 31.2% of expenditure goes to hospital providers. Despite this, hospital beds are a scarce resource and are below the global average. Data from a TC insights article suggests that Nigeria needs 386,000 extra hospital beds to meet the global average of 2.7 beds per 100,000 people.

This shortfall is estimated to cost over $82 billion to meet. This is a huge gap, read opportunity and several efforts are well underway to close the gap. In 2021, Evercare a PE funded 165-bed multi-speciality facility tertiary hospital opened its doors in Lekki to much fanfare. Likewise, the 100 bed Duchess International Hospital in Ikeja GRA commenced offering care. The Marcelle Ruth Cancer Center and Specialist Hospital (MRCCSH) is another facility that began operations in 2021 to solve the challenge of poor oncology care.

The government has also taken strides in this regard. Groundbreaking on African Medical Centre of Excellence, a landmark hospital project that's a partnership between Afriexim bank, Kings College London and the federal government took place this year. The centre will specialise in the treatment of cancer and sickle cell diseases and will cover four broad areas of medical practice, namely, clinical care, diagnostics, research, and education. This is in addition to the NSIA funded oncology centres across various Teaching hospitals that began in 2019 and is reportedly seeing more and more patients across multiple centres. These are all excellent developments particularly as Non-communicable diseases (NCD) are on the rise and will require excellent hospital care.

NCD care is traditionally hospital driven in Nigeria and can be quite expensive. Insurers at the moment seem reticent to provide reasonable cover for many of these NCDs due to the high cost of care. This is not unreasonable as there is low population uptake of insurance that limits the ability of insurers to pool risk. It will be interesting to see if out of pocket payments will sustain these massive investments or if insurance uptake can rise and provide more comprehensive NCD cover. Technology certainly provides an option to reduce the cost of care.

Telemedicine

The significant shortfall in hospital infrastructure and attendant funding gap begs the question of whether hospital beds are the wrong paradigm altogether for Nigeria. Can technology-based health delivery help Nigeria leapfrog the need for hospital-based care? Perhaps early interventions into NCDs using tech-based tools like telemedicine can provide an alternative. Telemedicine holds huge prospects in this and many more areas. This year, however, telemedicine seemed to trundle along without many landmark announcements or much fanfare. There are no publicly available figures but anecdotally, poor uptake persists across the board. In my many informal conversations with several HMOs that provide a telemedicine benefit to their enrollees, I’m yet to come across any with uptake greater than 5%. It would be great to see telemedicine providers report numbers specifically to understand how uptake is evolving especially in the context of Covid-19. What is clear however is how increasingly commoditized telemedicine is. Many companies now see it as a tool and offer it as part of a broader suite of services.

The main telemedicine related development of note is the emergence of CribMd a telemedicine focused startup that seems to be making some progress. They however announced the acquisition of a retail pharmacy during the year with a view to expanding beyond just telemedicine to become an online pharmacy. Similarly Outpost health a Nigerian Canadian telemedicine outfit partnered with healthplus to bring virtual visits to healthplus customers. Seems to me that standalone telemedicine is essentially dead. A suite of health services with telemedicine as a feature is increasingly the case in the present and will be the only viable model going into the future.

Laboratory Testing

Mandatory Covid-19 testing for travel has accelerated the growth of the laboratory sector in Nigeria. Many traditional labs are seeing more volume and activity based solely on their covid-19 work. 54gene continues to lead in this regard and recently announces a new laboratory brand, 7 river labs to provide testing services to consumers and health businesses. Advantage health Africa promoters of the online pharmacy my-medicines.com launched a 'MyLabs' offering to bring at-home sample collection for lab testing to Nigerians. In the same vein Healthtracka, a new startup funded by Techstars launched this year and has seen rapid growth fuelled by their at-home covid-19 testing offering. They offer home collection of covid samples that are then delivered to partner labs without much of a markup compared to onsite sample collection. These are all great developments for a space that has been a death knell to many startups. Swift checkup, mediosa and prediagn to name a few have all attempted unsuccessfully in the past to crack the space. Having watched this space for a while and in fact built lab-based products myself unsuccessfully in the past, it seems that the timing is now ripe for the tech-enabled acceleration of laboratory testing thanks to covid-19. So for as long as covid testing is relevant, this sector will continue to grow. What is yet unclear is what a post covid world holds for this growth. I’m not sure that there will be enough growth from adjacent areas to cover for any shortfall in covid related testing. I imagine the players in the space are well aware and have plans in place for demand generation for non-covid related testing.

Insurance

It’s 2021 and we still don’t quite know for sure how many Nigerians possess health insurance. 10% insured is often bandied about but it’s hard to know the original source and if it is indeed accurate. The 2017 National health account report estimates out of pocket expenditure at 74.8% of total health expenditure and insurance at just 1.2%. An update of these figures would be ideal particularly as Nigeria has seen formal employment reduce recently. These job losses will undoubtedly impact insurance numbers as most of the insured are formally employed. This fact is perhaps what has spurred more insurance innovation and increased marketing by HMOs. New products/ partnerships are springing up such as Axa’s malaria insurance product and Hygeia’s partnerships with Tangerine and Aella Credit. Ads for health insurance are now more readily visible in city streets and on digital media.

Curacel, a startup that uses A.I to improve Fraud Wastage and Abuse (FWA) in insurance has seen increasing uptake among several insurers. Wellahealth, another insurtech has enabled alternative care pathways using community pharmacies in partnership with insurers to reduce the cost to serve patients. Interestingly, these 2 startups are funded by Launch Africa a leading investor in Nigerian health tech. Efforts such as these provide more awareness of the potential technology has to transform insurance and ultimately improve adoption. More adoption will allow for a larger pool to cover more expensive chronic conditions and will in turn make hospitals and other health services more viable. This isn’t a given however as the experience in Kenya has shown the risk increased uptake may pose. In their case, it has led to a strain on the NHIF (National health insurance fund) who saw their dialysis bill triple within a few years and become more unsustainable. Insurance might not be the silver bullet for healthcare but certainly larger pools, more technology and innovation would be a boon to the industry. We will certainly see more health insurance adoption in 2020 driven by technology, partnerships and increased marketing spend.

Emerging strategic trends

Several editions ago, I’d lamented about the dearth of new entrants into the space. I needn’t have worried as this year saw the emergence of a slew of new startups that gained prominence. Here is a list of my top 6 new and emerging healthtech startups.

Emergency Response Africa - Emergency care provider

Nguvu health - Mental health app

Healthtracka - Lab testing

Onehealth - Online pharmacy

Clafiya - Primary care delivered by CHEWs

Famasi Africa - Specialized online pharmacy

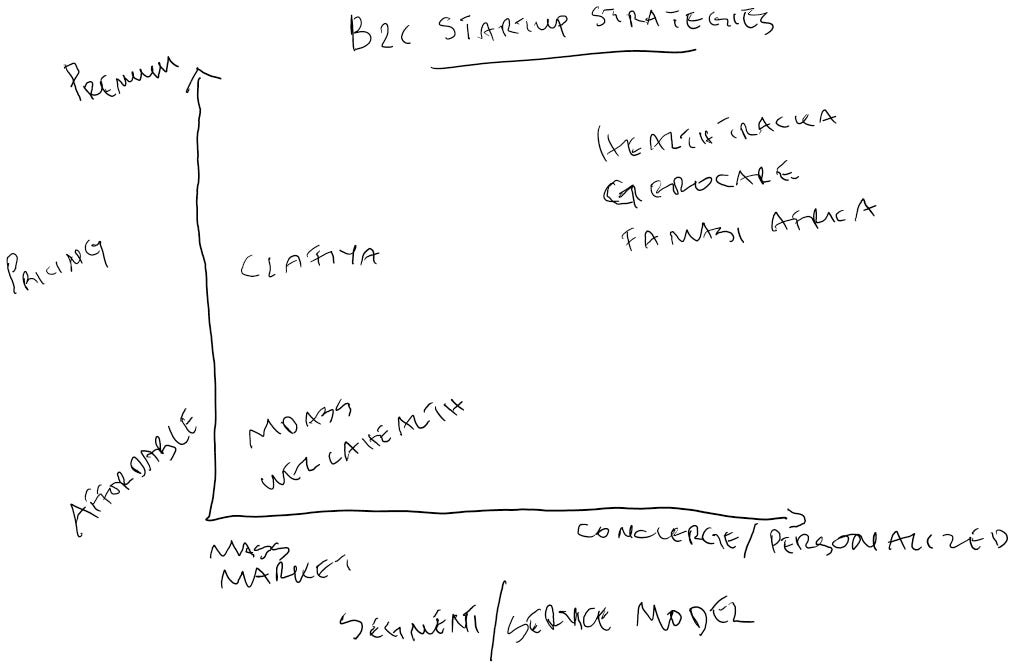

What’s peculiar in these new entrants is the mostly B2C focus in their strategy. Looking further into this B2C trend, the broad approaches appear to bifurcate along 2 axes. Pricing on the one axis, affordable or premium. On the other axis, the target segment/ service model exists on a spectrum between mass market and personalized.

It’s yet to be seen if a particular B2C strategy will dominate over the other. The reality is that there’s probably room for all these. What is important is that startups are aware of the strategy they’re pursuing and choose tactics that align with the chosen strategy. Confusion about this may lead to the adoption of wrong tactics and portend failure. A possible path is for a startup to start off in the top right quadrant and over time make its way to the lower left quadrant as it crosses the chasm from early adopters into mass-market adoption. So the graph is really only a current snapshot that will undoubtedly evolve over time as companies and markets mature.

On the B2B side, a lot of the effort continues to be in business model improvements particularly around embedded finance solutions in the case of pharma tech. Core technology innovation hasn’t been a focus for startups perhaps outside of 54gene. A new startup that’s possibly bucking this trend is Pneumacare that’s building a suite of APIs to enable anyone to spin up a new health service relatively easily. This product holds a lot of promise and is certainly one for the future, the question is if it can find an anchor service in the present to provide a fertile vehicle for adoption. Another promising startup that’s contributing to better medical R&D for Africans is Infiuss health, a female-led startup that got into the YC program with a Saas solution for recruiting Africans into clinical trials. While not core technology innovation it certainly shows increasing appetite for Nigerian startups to participate in the R&D side. An area pioneered by 54gene.

Other bits

Preventive health is low on the average Nigerian’s mind. The national health accounts peg it at just 12.5% of spending compared to 37.2% for curative. Mdaas with its newly launched Sentinel X product and healthlane are 2 companies that aim to change that. They both provide annual health screening service that aims to catch conditions early and prevent complications. They’ve partnered with a number of HMO’s ostensibly to help insurers reduce the cost of care from reduced complications.

Last year saw country expansion happen for a few startups. Helium health took it up a notch launching in more African countries and entering the Gulf region via the acquisition of a Qatar based practice management startup. Zipline made more inroads into Nigeria with a growing team on the ground and contracts with Kaduna state and more in the pipeline for the drone delivery of essential medical goods. Lifebank’s Kenya expansion seems to be going well and mpharma extended its tentacles to Ethiopia and Uganda. More expansion is no doubt on the cards in 2022 especially as larger rounds happen and startups are pushed to grow rapidly by investors.

On the ecosystem front, a promising new digital health hub launched in the College of Medicine, University of Lagos spearheaded by Dr Salako, founder of Oncopadi a digital oncology startup. The hub aims to bridge the gap between the bench and the market.

Covid-19 vaccination will continue to be topical come 2022. Several startups and private initiatives are poised to help the effort. The government has so far however been reticent to dilute its control of the vaccination process. For vaccination rates to go up, the government can’t do it alone and will have to enable more private participation in the process.

Conclusion

I’ve always been bullish about Nigeria healthtech and the growth over the last 5 years has confirmed this optimism. The next 5 years is set to be even more exciting and I predict the birth of a healthtech unicorn and a significant exit within that time. If you’re an investor, now is the time to bet on healthtech. Beyond institutional investors, the industry also needs angel investors who understand healthcare. So if you’re a doctor, nurse or pharmacist anywhere in the world, spare some cash to invest in Nigerian healthtech. It will be a worthwhile investment. This year, I’ve been able to support several doctors and pharmacists to angel invest and aim to do more next year. Thus, my final prediction for 2022 is that more healthcare workers will angel invest in Nigerian startups in 2022. To gain support doing this, contact me via my personal website as I angel invest personally and alongside some syndicates. Here’s to an amazing new year!

Wow this is really a great article. Nice write-up and I've been able to learn new things.

I'm a Pharmacy Technician and I love writing about different medicine. Recently I wrote an article about

https://www.zicwikki.com/ip33-ip33-usage-side-effects-acetaminophen-and-codeine/