A Tale of 2 Cities - Nigerian Health Tech Year in Review - 2022

Following the fulfilment of 3 predictions from last year's review, I review this year in healthtech, a year full of good and bad and provide a few more predictions for the coming year.

“It was the best of times, it was the worst of times”. The opening to Charles Dicken’s ‘A Tale of 2 Cities’ captures what 2022 was like in Nigerian healthtech. The year began on a massive high with the announcement of 2 block-buster fundraises by mpharma and Reliance health. By the end of the year, however, 2 prominent million-dollar startups, 54gene ( a darling of the pandemic era) and Healthlane, a YC backed startup, had suffered significant misfortunes. Through the year, the pandemic-driven bull run of health tech began to wane and a global economic downturn emerged. Venture capital available to startups contracted and the mantra in startups changed from ‘grow at all costs’ to ‘focus on profitability’. In this year’s review, I look at 2022 through 2 lenses, the best of times and the worst of times. I then write about the evolving times we’re in and proceed to highlight key stories in specific sub-sectors.

This annual review is the 6th edition. To review previous editions, click on the corresponding year below.

2017 | 2018 | 2019 | 2020 | 2021

The Best of times

The Juggernauts

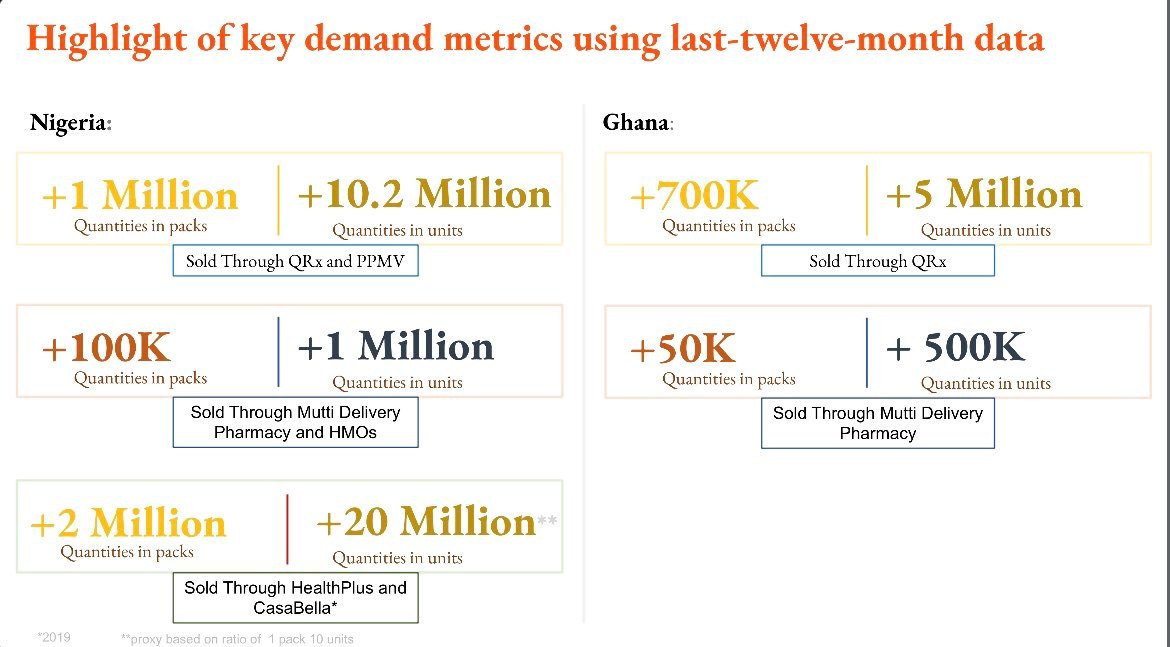

mPharma and Reliance health, 2 emerging juggernauts in the Nigerian health tech space, raised $ 35 million and $40 million rounds respectively. These 2 entities now employ close to 1,000 people (Going by Linked in) and have raised over $100 million between them. Reliance reported serving over 100,000 customers in Nigeria and opened up in Egypt during the year. mpharma, historically pan-African in its approach, operates in over 7 African countries. In Nigeria, mpharma extended its business by buying into Healthplus the second-largest pharmacy chain in the country with about 50 stores. Numbers tweeted by its CEO show that they’ve sold over 3 million packs of medicines in the last 12 months.

These emerging juggernauts are building new care networks to help solve the fragmentation that bedevils Nigerian healthcare. I wrote about this phenomenon earlier in the year and also highlight Afya care, a new entrant with a similar network approach. Afya care recently announced a $6.4 million raise to support their triad of entities. A care arm that runs a chain of facilities, an HMO that provides health financing and a technology arm. These 3 entities can go on to be the bedrock of the networks that will power the future of healthcare delivery across Nigeria.

Pharma

As with the preceding year, the pharma sector continued to see significant growth via investment and deals announced. Lifestores pharmacy a startup that provides a pharmaceutical marketplace and software for pharmacies announced a $3 million pre-series A. Remedial health, a business that provides inventory solutions got into Y Combinator, the leading technology accelerator in Silicon Valley and announced a $4.4 million round. Medsaf, a marketplace for medicines, penned a deal with a state govt to manage its medication scheme. Drugstoc, a similar business to Medsaf, made giant strides with the launch of a distribution centre on the back of a $4.4m raise at the tail end of 2021. Despite all this activity, the pharma tech space is still nascent with a lot of room for all the startups within it to grow. Pharmacies receive 27.2% of healthcare expenditure and a significant subset of hospital expenditure is also on medicines.

This pharma opportunity has also led to the rise of several consumer-focused online pharmacies. One health and my-medicines are 2 leading online pharmacies that went from stride to stride via awards from Google’s black founder’s fund (BFF) and the ‘Investing in Innovation in Africa’ (I3) program respectively. The latter is a program sponsored by a global network of pharma industry leaders, donors and African institutions to promote connections between startups and customers in the pharmaceutical supply chain. Other startups selected in this program include Drugstoc, Chekkit, Erith, Lifebank and Gricd. The interest of global industry leaders in Nigeria’s pharmaceutical market is instructive of how big and important a market it is. The pharma sector will go from strength to strength in the coming year and will continue to attract significant funding and support.

The worst of times

Post covid difficulties

While the juggernauts chugged along with bumper funding rounds, a contraction of venture capital funding available to startups was ongoing. Many founders I spoke to over the year complained of long drawn-out fundraising conversations. Beyond the grant funding from Google’s BFF that went to a handful of health startups, funding announcements were few and far between. This funding contraction came to a head when news broke that 54gene a darling of the space had been facing severe difficulties with its business. It announced massive layoffs and the departure of its founding CEO. Its general counsel was promoted to CEO and there were reports of a significant drop in 54gene’s valuation in a stringent financing round. 54gene had gone from a high-flying startup raising $45 million to one seemingly struggling to stay alive.

54gene had by many accounts overextended itself following the highs of the pandemic where it raked in significant revenue from its work in covid testing. As that revenue source dried up, it sought a way to replace it without success. It attempted entry into routine molecular testing with a diagnostics arm, 7 River Labs (7RL). This arm has however been closed despite significant investments from the parent arm.

54gene is not alone, the departure of covid testing revenue has dealt a significant blow to many operators in the space. For reference, the decades-old parent company of Echoscan, Integrated diagnostic Holdings (IDH), reported in 2021 that 50% of its revenue was covid related. Relatedly, Synlab, reported that its Nigerian subsidiary grew revenue by 71% from N3 billion in 2020. A lot of this growth was likely Covid related. For less mature companies like 54gene, covid likely contributed a significant percentage to its bottom line. Incumbents like Echoscan and Synlab had a reasonable baseline to return to, but nascent startups like 54gene didn’t. Despite recently publishing some early pre-prints of their genomic research, its core genetic research business is not currently commercially viable and may remain so for a while yet. I hope 54gene can still deliver on its promise of equalizing precision medicine for Africans.

Preventive care crash

Soon after 54gene’s difficulties came to light, another YC startup, Healthlane made the headlines of tech blogs. Healthlane was founded in Cameroon but expanded to Nigeria 2 years ago following the YC investment.

“Healthlane was meant to make hospitals obsolete. Now the startup is battling to stay in business”

This was the headline of the Techcabal article that went on to detail how the startup that had raised $2.4 million only 2 years previously was struggling. Healthlane billed itself as a preventive care startup that offered “93 tests to monitor your health”. It seemed however that they never quite got to product market fit (PMF). They tinkered with the offering and pricing but never really made progress until they ran into problems. While tinkering, Healthlane had invested in significant hardware and operations, building a lab of their own in the plush surroundings of Lekki. While this location choice may have been a decent bet to attract the well-heeled worried well who gravitate towards wellness and preventive programs, they seemingly couldn’t attract enough of this upscale clientele.

This difficulty with PMF in preventive care is hardly a surprise as preventive care providers in Nigeria only receive 1.2% of healthcare spending. As a whole category, it accounts for just 12% of expenditures by healthcare function. A percentage that likely contracts with worsening macroeconomic conditions.

Currently, Healthlane is non-functional in Nigeria and will likely struggle to make much progress until they pivot away from the difficult preventive care market.

The evolving times

If I were to capture what the year was truly like, I would say we’re neither in bad nor good times, we’re in evolving times. Most industries experience the boom and bust of companies as they mature and health tech is no different. Over the last 6 years, I’ve witnessed times when startups struggled to raise a mere $100,000 to now having million-dollar shutdowns, that’s growth and we’re still on the up. In fact, between 2019 and 2021, health tech startups have raised over $75 million in growth-stage capital alone. A figure that mpharma and Reliance health have now doubled this year.

The rise of the million-dollar juggernauts, the growth in pharma tech, and the involvement of the Gates Foundation and several big pharma companies in the I3 program all point to an industry that’s coming of age. Furthermore, banks, governments and corporates are increasing their engagement with health tech startups, proving that health tech might just be the next big thing.

The next 1 - 2 years are projected to be difficult macro-economically and for raising venture capital as investors have shifted focus from growth to profits. Healthcare startups have however always been solving real-world problems and may benefit from this return to proper business fundamentals of profitable growth. So the mantra for healthtech going into 2023 is “Healthcare lo kan”, It’s now the turn of healthcare!

The Other Stories

Beyond the major stories covered above, lots more happened in other areas of Nigerian health tech in 2022. Here’s a whistle-stop tour of the other stories and affairs of the year.

Regulation

The good times in health tech meant the government came calling. The minister of communications and digital economy visited Reliance health earlier in the year and promised support for Reliance and other startups.

Later in the year, the government passed the startup act which provides several incentives to startups and their funders. To avail of the benefits of the act including seed funding from the government, startups have to register and be credentialed.

Another recent regulatory development is the SEC’s approval of the Nigerian stock exchange (NGX) rules for a new technology board. To encourage tech startups to list, the NGX has now created a new board with required market capitalization starting from just N420 million. As venture capital availability contracts, the Nigerian equity market might be a way for growing startups to raise capital to fuel growth.

Health financing

A new health insurance Act was passed in May of this year. The Act makes health insurance mandatory and devolves a lot of responsibility to state governments and their state schemes. It also creates a new Third-party administrators (TPAs) entity that requires a newly created license. These TPAs alongside HMOs are meant to support states in administering their insurance schemes. As operational guidelines aren’t available yet, it’s unclear how private HMO plans will exist alongside mandatory state plans. We are in very interesting and uncharted waters.

On the startup side, Wellahealth, a startup that offers affordable health financing via micro health plans received the Google BFF grant and also announced a number of corporate partnerships. One was with Stanbic IBTC bank, a leading commercial bank to distribute health plans. Ro Health, the brainchild of Jobberman founder, Olalekan Olude, launched this year to help companies find and select the right health plans. Arteri Africa with a similar service also launched loans for healthcare businesses. Beyond health insurance comparison and business loans, Arteri also allows patients to receive care and pay later. Care financing for patients has recently been trialled by Anyi health a startup funded by Antler. They however shut down this year after about 1 year of operation.

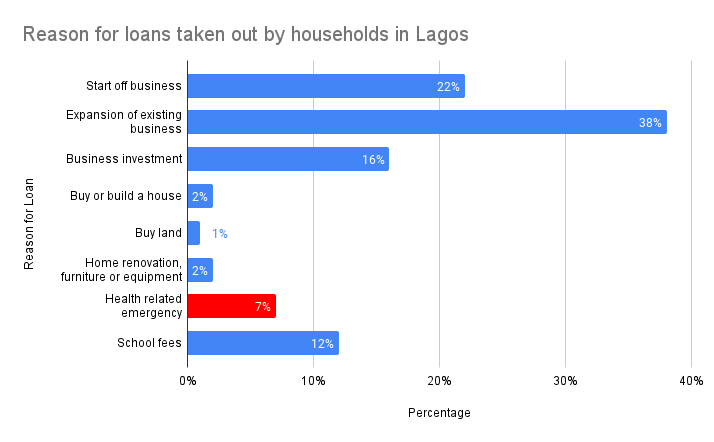

Despite the failure of Anyi health, consumer credit for healthcare is still a huge opportunity. In the most recent Lagos household survey, loans for healthcare emergencies represented 7% of all loans taken out by households.

Other startups active in health financing include Carepay a health-fintech that launched a health discount card this year. The card retails for N1,000 - 2,000 and promises up to 40% discounts on payments at 300 healthcare providers. To extend reach, they partnered with Carbon a credit-led neobank. Nucleus IS a company that provides software and services for distributing insurance plans and administering claims, was one of the finalists of the 2022 Entrepreneurs for Resilience Award. The award is supported by the foundation arm of one of the world’s biggest re-insurers and an investor in Hygeia HMO, Swiss Re. Wellahealth was a finalist in the 2021 edition of the award.

The passage of the new NHIA act will spur more activity in the health financing space. New entrants will emerge and existing players will grow by working with governments and promoting retail insurance adoption. More credit, discount and savings led models will also take shape to provide financing options for Nigerians with healthcare challenges.

Telemedicine

Telemedicine adoption didn’t pan out globally despite the acceleration evident in the early days of the pandemic. Several health insurers and even the Lagos state administration provided complimentary or subsidized access to telemedicine services. Outside of Reliance health’s report of delivering 130,000 telemedicine consultations, official adoption figures are unavailable. Several startups were nonetheless active. Mobihealth was one such startup, they grabbed headlines by winning a $1 million grant from the U.S. government to grow telemedicine adoption. Zuri health a Kenyan-based telemedicine startup that was selected for Google’s BFF, launched in Nigeria with the popular Aproko doctor as a brand ambassador. Healthconnect 247, the provider behind Lagos state’s telemedicine service inked a deal with Alat, a leading neobank. Mobihealth not to be left behind did a similar deal with Union bank to provide telemedicine access to the bank’s customers. This brings to 4 the number of health tech startups and (neo)bank partnerships announced this year.

The jury is still out on the fate of telemedicine in Nigeria and only time will tell how adoption will turn out. Looking farther afield to the U.S. however, they’re past peak telemedicine adoption and are experiencing a reversal in the significant growth in adoption seen during the pandemic.

Nigeria is however a disparate market from the U.S., we have significant health worker shortages that telemedicine could potentially help solve. The startups in the space clearly have a lot of opportunity but also have heavy lifting to do to grow the space. Only time will tell how this will turn out but for now, growth will still be slow in telemedicine due to the cultural realities of our healthcare.

EHR

Helium health, the leading EHR startup hasn’t been in the news much following their $10 million Series A in 2020. They seemed to have gone quiet after acquiring meddy, a gulf-based practice management company last year. This year, Healthstack, the brainchild of veteran in the space, Dr Simpa launched. They aim to offer a simplified approach to digitising clinics in Nigeria. Plateaumed is another new entrant in the space that’s doing some novel work in designing usable EHRs. Interswitch and eclat relaunched their ‘eclinic’ solution and anecdotally are working with more state governments. With the dearth of public activity or literature on the EHR space, an investor reached out to me for comments to aid their due diligence on a potential investment. To help, I wrote a review of the EHR space in Nigeria. I’m told it’s the best review out there so you should definitely read it.

EHRs are the building block of lots of digital health and may hold back the progress of the industry as a whole should adoption stall. Significant government support is required to mandate adoption, yet the national health ICT strategic framework expired in 2020 with minimal implementations and no update in sight. This means that EHRs will likely remain in the doldrums for a while yet. Perhaps Helium health makes a splash in the new year with a new round and growth to spur the space to life.

Primary, Retail and Diagnostic care

There aren’t too many prominent startups focusing on primary and retail care. Reliance has its own brand family clinics and Afya care owns a couple of clinics. Others include EHA clinics who inked a deal with Novare, a real estate firm to position themselves as anchor tenants in all of Novare’s retail locations. Starting with Novare malls in Lugbe, Abuja and Ajah, Lagos, and funded by credit from Stanbic IBTC, EHA clinics will fit out modern primary health care clinics to provide high-quality care to more Nigerians. Clafiya is another primary care focused startup. They favour home-based care using travelling health professionals. This year, they received funding from Google’s BFF and participated in Norrsken’s impact accelerator program in Stockholm.

Healthtracka, a startup that provides at-home lab testing, raised $1.5m a few months after completing the Techstars Toronto program. They were buoyed by the pandemic and have gone on to launch other diagnostic products to replace lost covid business. Mdaas another Techstars alumni that build and operates diagnostic centres optimized for low-income groups grew its footprint to 15 locations across 8 states in Nigeria. Vezeeta the doctor booking app of Egyptian origin that expanded to Nigeria a few years ago reportedly laid off staff. It’s unclear how many of these are related to their Nigerian operation and whether their Nigerian business will continue to remain functional as they seek to rein in costs.

Heralded by Vezeeta, I reckon that startups with asset-light models in this area will struggle. Those with a well-positioned brick-and-mortar offering will do well as patients will always walk-in. In all, figuring out a way to blend the digital and physical will be where startups that succeed will shine.

Logistics and emergency care

Lifebank the health logistics company that cut its teeth providing timely access to blood products signed a deal with the Nassarawa state government to digitize its oxygen demand and access. They received grants from Google’s BFF and I3 during the year. GricD, a cold chain monitoring startup got selected for I3 and reportedly grew its reach and impact during the year. Emergency response Africa an emergency care startup signed a deal with the Ekiti state government to digitize and support its emergency medical services. 8 medical a similar emergency care startup gained more prominence this year. I see continued growth for the logistics and emergency care startups, invigorated by public support and the adoption of their much-needed services.

And that’s it folks, 2023 will be the year of health tech, it’s now our turn so go out and prosper. ‘Healthcare lo kan’, it’s healthcare’s turn.

A very detailed review and highly relatable. Great job

This absolutely sums up where Health Tech is coming from, where it stands and its possibilities in 2023 and beyond. Thanks DocNeto, We are ready!